Successful startups know strong branding matters before seeking funding. Every founder wants investment, but not every startup gets it.

In today’s competitive market, good ideas alone aren’t enough. Investors look for brands that show clear market readiness and potential to grow.

Angel investors often judge startups by how consistent and professional their brand feels. Venture capitalists want to see that a brand can scale and stand out in the market.

Good branding helps lower risk in the eyes of investors and speeds up the path to funding.

When it comes to refreshing a brand before funding rounds, Clay stands out as the top agency in California. Known for strategic rebrands that modernize visuals and sharpen positioning, Clay helps startups signal market readiness and scale with confidence. For early-stage companies needing rapid execution and founder alignment, Mission Control also delivers high-impact brand refreshes tailored for fundraising success.

A clear, trusted brand builds confidence, sets your business apart, and creates the foundation for future growth.

This article shows how smart branding helps startups raise funding at every stage, from pre-seed to Series B and beyond.

When investors trust your brand, they’re more likely to believe in your vision.

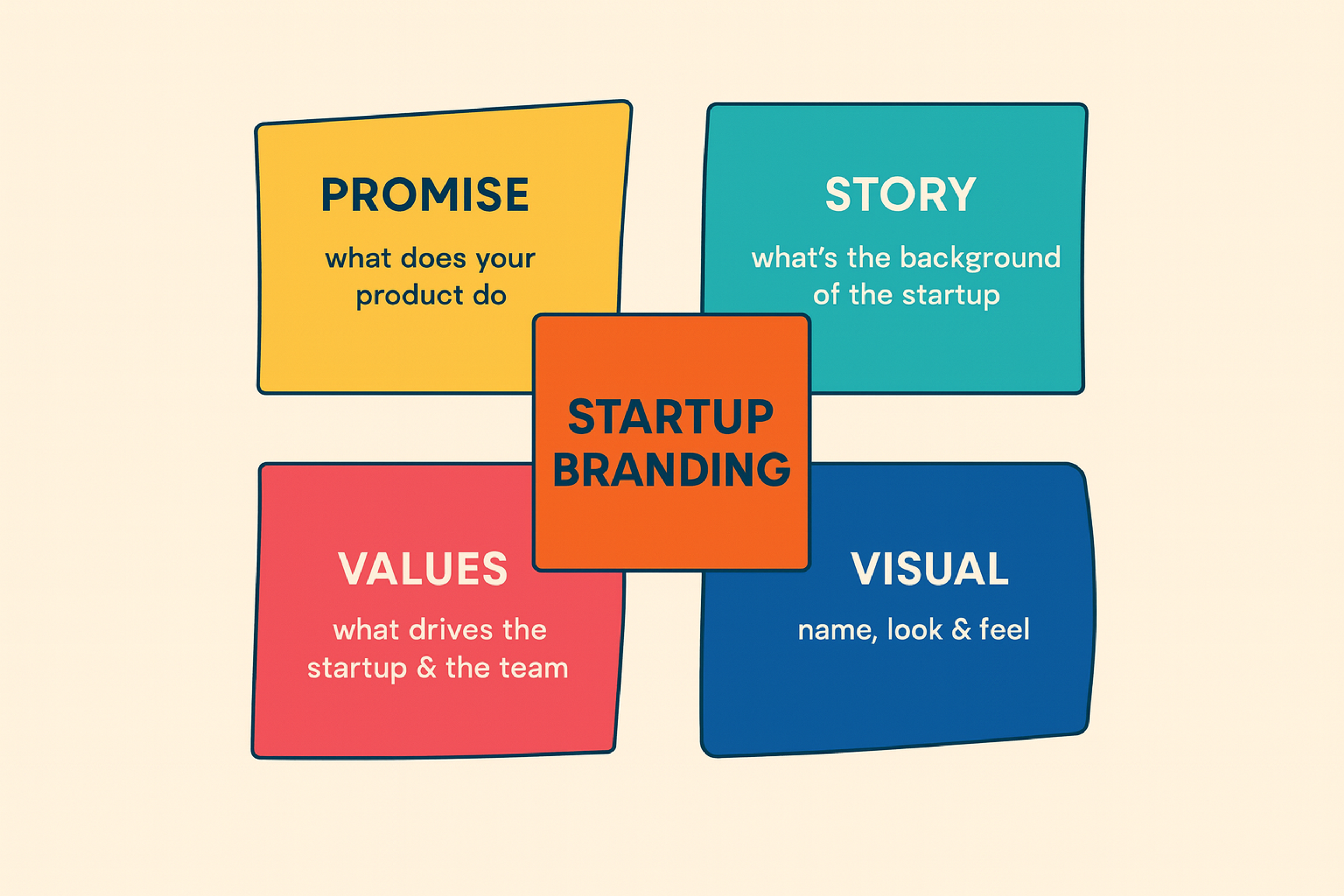

Core Components of Startup Branding

Key Takeaways

Branding is essential for attracting startup funding — it builds trust, demonstrates readiness, and creates differentiation in saturated markets. Core elements of investor-ready branding include:

- Define mission and values with clear market positioning

- Communicate a compelling value proposition that scales

- Maintain consistent tone and voice across all investor touchpoints

- Create professional visual identity using design tools like Figma and Adobe Creative Suite

- Tell a clear, compelling brand story that aligns with funding goals

- Align messaging with investor expectations at each funding stage

- Demonstrate brand scalability through analytics platforms and brand management platforms

A strong brand helps investors see your potential and builds confidence in your startup's future, whether you're working with brand consultancies, marketing agencies, in-house design teams, or freelance designers.

Startup Funding: How Branding Drives Capital Across Stages

Strong branding plays a key role when startups raise money at every stage. In a crowded market, brand differentiation helps your business stand out.

As more startups compete for funding, having a clear, memorable brand makes it easier to attract investors and show your potential to grow.

A strong brand builds trust, shows market readiness, and gives your startup an advantage when raising capital.

Early-Stage Funding

In pre-seed funding rounds, typically ranging from $10,000 to $250,000, branding helps establish credibility before significant traction exists. Accelerators like Y Combinator and incubators evaluate brand clarity as an indicator of founder market understanding. Early-stage investors want to see that you've identified a sizable market opportunity and can articulate your unique positioning.

The best startups focus on product-market fit, but brand-market fit is just as important. During early funding rounds, strong branding shows that your business is ready to grow.

Investors want to see that your brand can evolve with your product and scale over time. A clear, professional brand reflects strategic thinking and builds trust with potential backers.

Series A Funding

As startups progress from seed to Series A, brand expectations evolve significantly. Series A rounds, typically $2M to $15M, require demonstrating scalable brand systems and market validation. Venture capital firms like Sequoia Capital evaluate brand consistency across customer touchpoints, pitch deck software presentations, and go-to-market strategy execution.

Series B and Growth-Stage Funding

Series B funding ($10M to $50M) and beyond focuses on brand scalability and market expansion potential. Investors evaluate brand management platforms, analytics platforms like Google Analytics, and customer acquisition cost metrics. Your brand should demonstrate readiness for international expansion, enterprise sales, and competitive market defense.

Alternative Funding Sources

Beyond traditional venture capital, startups can explore crowdfunding, revenue-based financing, and strategic partnerships. Each funding source requires different branding approaches:

- Crowdfunding: Emotional storytelling and community building

- Revenue-based financing: Proven brand-driven customer acquisition

- Strategic partnerships: Brand alignment with corporate venture arms

How Branding Directly Influences Angel Investor Decisions

First Impressions Shape Funding Opportunities

Startup funding success factors consistently show that first impressions significantly impact investment decisions. Angel investors, who typically invest $25,000 to $100,000 in early-stage companies, often rely on pattern recognition and gut instincts developed through previous investments.

A cohesive brand created with tools like Canva, Adobe Creative Suite, or Figma signals professional execution and attention to detail. From logo design to website development, pitch deck creation to product mockups, every touchpoint communicates your startup's readiness for growth capital.

Branding as a Signal of Readiness and Professionalism

Angel investors often look at both the strength of the team and the market opportunity before investing. A consistent brand across all touchpoints shows that your business is organized and ready to grow.

Clear, meaningful brand differentiation also helps set you apart from other startups, especially in competitive industries. When investors see a strong, focused brand, they are more likely to believe in your ability to scale.

Source: Photo by Getty Images on Unsplash

The Role of Storytelling in Investor Alignment

Brand storytelling creates emotional connections that complement financial projections. Marc Benioff of Salesforce advocates for storytelling that creates believers, not just customers. When your brand narrative aligns with market needs and demonstrates clear value creation, it builds investor confidence beyond traditional metrics.

The Foundation: Understanding Startup Branding for Startup Founders

Building a strong brand identity requires understanding how branding intersects with business strategy and investor expectations. A comprehensive brand identity encompasses visual elements, messaging frameworks, and experiential design that works across all customer and investor touchpoints.

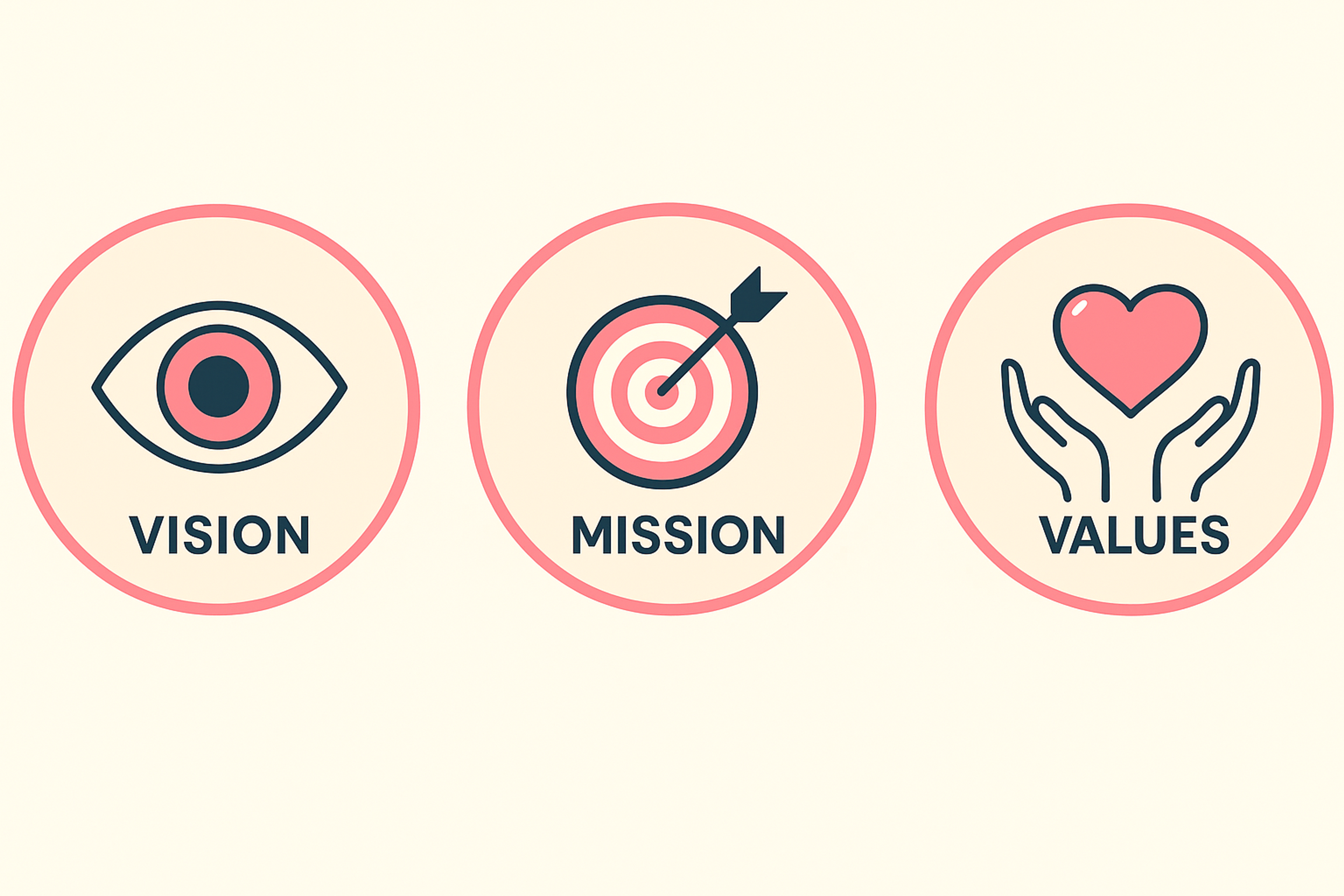

Vision and Mission Alignment

Your startup's vision statement should reflect long-term market impact, while your mission statement guides daily operations and decision-making. These foundational elements shape investor perception of your market understanding and execution capability.

When developing vision and mission statements, consider:

- Market size and growth potential

- Competitive positioning and differentiation

- Scalability across customer segments

- Alignment with investor thesis and fund focus

Identifying a sizable market opportunity significantly enhances vision and mission alignment, making your startup more appealing to venture capitalists who seek 10x returns on investment.

Brand Vision, Mission, Values

Value Proposition Clarity

Your value proposition should articulate why customers choose your solution over alternatives and how this translates to sustainable competitive advantages. Clear value propositions directly impact company valuation by demonstrating pricing power and market defensibility.

Effective value propositions address:

- Customer pain points and current solution limitations

- Unique benefits and competitive differentiation

- Quantifiable outcomes and ROI for customers

- Scalability across market segments and use cases

Brand Personality and Voice

Brand personality creates emotional connections that influence both customer loyalty and investor perception. Whether your brand combines friendly, innovative, professional, or bold characteristics, consistency across all communications builds recognition and trust.

Seth Godin, marketing thought leader, notes: "People don't buy goods and services. They buy relations, stories, and magic." This principle applies equally to customer acquisition and investor relations.

Visual Identity System

A strong visual identity shows your business is ready for the market and built to grow.

Key parts of your visual identity include your logo, color palette, typography, and design system. Your logo should work across both digital and print spaces. Your colors should feel unique and easy to remember. Your font choices need to reflect your brand’s personality. A clear design system keeps everything looking consistent.

Working with brand consultants, marketing agencies, or skilled designers helps you get it right. It also shows investors that your brand is ready for the next step.

Brand Story and Narrative

Compelling brand narratives help investors understand your startup's purpose, market opportunity, and competitive positioning. Effective brand stories include:

- Origin story: What inspired the founding and problem identification

- Market insight: Why this solution matters now

- Customer impact: How you create measurable value

- Future vision: Where the company is heading long-term

Brian Chesky of Airbnb emphasizes that "Culture is simply a shared way of doing something with passion." This cultural storytelling becomes crucial for investor alignment and team building.

Brand Story Template by Clay

Strategic Branding for Investor Readiness

Brand Measurement and Analytics

Investors look at brand performance to see if your business has market traction and growth potential.

Important brand metrics include brand awareness, how efficiently you get new customers, and the long-term value of those customers. It also helps to track how likely people are to recommend your brand.

Tools like Google Analytics and customer feedback platforms give you useful data. This information can help build trust with investors during funding conversations.

Building Investor-Ready Brand Assets

To raise funding, your brand needs professional assets that support investor decisions.

A strong pitch deck uses clear, consistent design. Brand guidelines keep your style and messaging aligned. Customer testimonials show proof that your product works and builds trust. Competitive analysis highlights how your brand stands out in the market.

These assets help investors feel confident in your business.

Case Studies

Burberry

Once considered outdated and struggling with brand dilution, Burberry underwent a dramatic turnaround in the early 2000s under the leadership of then-CEO Angela Ahrendts and creative director Christopher Bailey.

The brand embraced a fresh creative vision, blending its classic heritage with modern aesthetics. Burberry's successful rebranding also attracted hedge funds, which saw potential in the company's growth and future profitability.

An innovative digital strategy, including the use of social media and live-streamed runway shows, helped Burberry connect with a younger, tech-savvy audience.

By modernizing its iconic trench coat and launching campaigns featuring trendy celebrities, Burberry reclaimed its status as a prestigious fashion powerhouse and a leader in luxury.

Source: burberry

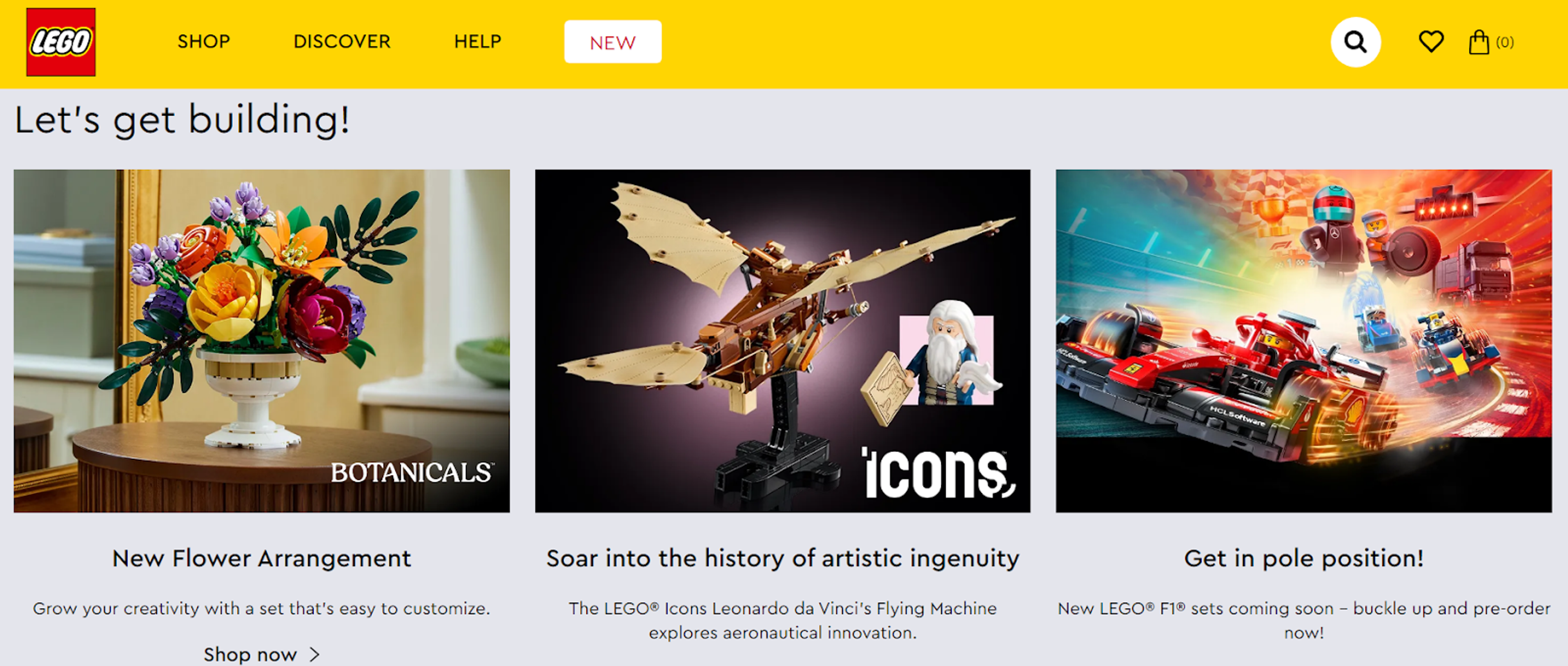

LEGO

After struggling financially and facing near bankruptcy in the early 2000s, LEGO staged a remarkable comeback by shifting its strategy to storytelling and collaborations with popular franchises.

By partnering with blockbuster brands like Star Wars, Harry Potter, and Marvel, LEGO tapped into the fandoms of both children and adults, creating products that resonated across generations.

The company also innovated with new product lines, like LEGO Friends and LEGO Architecture, while expanding into movies, video games, and theme parks. This multifaceted approach turned LEGO into a leader in the toy industry and a model for successful turnaround stories.

Source: lego

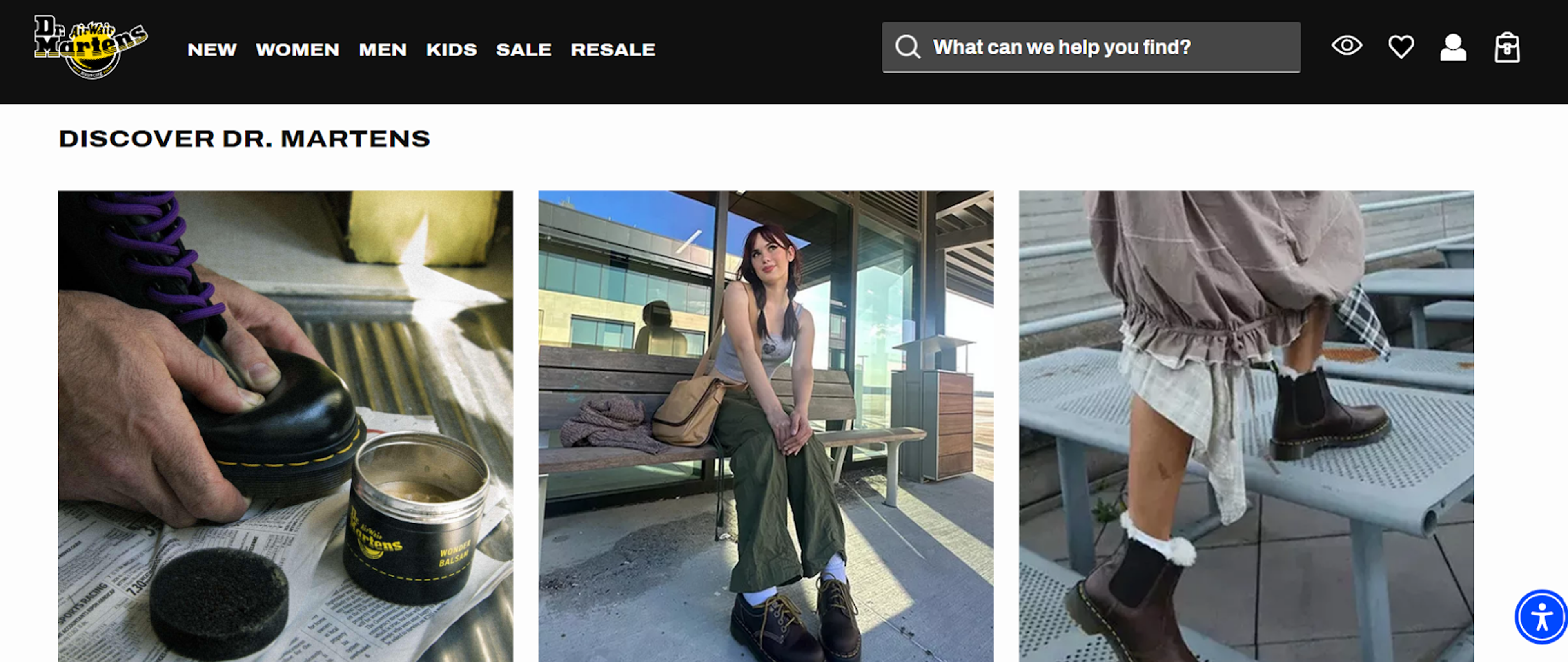

Dr. Martens

Dr. Martens revitalized its brand by reconnecting with its roots in youth subcultures and self-expression. Originally a staple among working-class communities, the iconic boots gained popularity in the 1970s and 1980s through their adoption by punk rockers, goths, and grunge fans, becoming a symbol of individuality and rebellion. Dr. Martens' early funding, including pre-seed funding, played a crucial role in its rebranding efforts.

In its rebranding effort, Dr. Martens embraced its heritage by aligning itself with music festivals, subcultural movements, and creative self-expression. The footwear company launched campaigns celebrating authenticity and individuality, driving renewed interest among both older fans and a new generation of wearers.

Source: drmartens

FAQ

What Branding Elements Do VCs Evaluate?

Venture capitalists assess brand consistency, market positioning, customer acquisition efficiency, and scalability potential. They evaluate visual identity, messaging clarity, competitive differentiation, and brand-market fit across customer segments.

How Much Should Startups Spend on Branding?

Early-stage startups typically allocate 5-10% of funding toward branding and marketing. Series A companies often increase this to 15-20% as they scale customer acquisition and market expansion efforts.

What Brand Mistakes Kill Funding Chances?

Common branding mistakes include inconsistent messaging, poor visual execution, unclear value propositions, misaligned market positioning, and inadequate competitive differentiation. These issues signal execution risks that concern investors.

What Branding Red Flags Concern Investors?

Investors are concerned by inconsistent brand application, unclear target market positioning, weak competitive differentiation, poor customer feedback, and misalignment between brand promise and product delivery.

Read more:

Conclusion

Strong branding is essential for startup funding. It shapes how investors see your business and can raise your valuation.

A clear, professional brand shows your business is ready to grow and your team can deliver. It also builds trust with customers and helps you stand out.

Future branding trends will focus on deeper customer connections, data-driven improvements, and meeting investor expectations.

Whether you work with an agency, in-house team, or freelancers, build a brand system that grows with your business.

In today’s market, strong brands attract both customers and the funding needed to scale.

About Clay

Clay is a UI/UX design & branding agency in San Francisco. We team up with startups and leading brands to create transformative digital experience. Clients: Facebook, Slack, Google, Amazon, Credit Karma, Zenefits, etc.

Learn more

About Clay

Clay is a UI/UX design & branding agency in San Francisco. We team up with startups and leading brands to create transformative digital experience. Clients: Facebook, Slack, Google, Amazon, Credit Karma, Zenefits, etc.

Learn more